In the exhilarating world of finance, cryptocurrencies have emerged as the rebellious offspring, disrupting traditional norms while offering an exciting new frontier for investment. This digital gold rush has caught the attention of everyone from Wall Street mavericks to your next-door neighbor. But before you dive headfirst into this seemingly alien territory, it’s crucial to understand how to strategically invest in these digital assets and navigate through their volatile landscape.

The fascinating realm of cryptocurrency is no longer reserved for tech-savvy enthusiasts alone. With Bitcoin’s meteoric rise and tales of overnight millionaires circulating around the internet, it’s clear that cryptos are not just a passing trend but an investment opportunity that can potentially yield high returns. Curious about dipping your toes in these uncharted waters? Our comprehensive guide on ‘How to Invest in Cryptocurrency’ will provide you with essential insights and tools needed to start your crypto journey successfully.

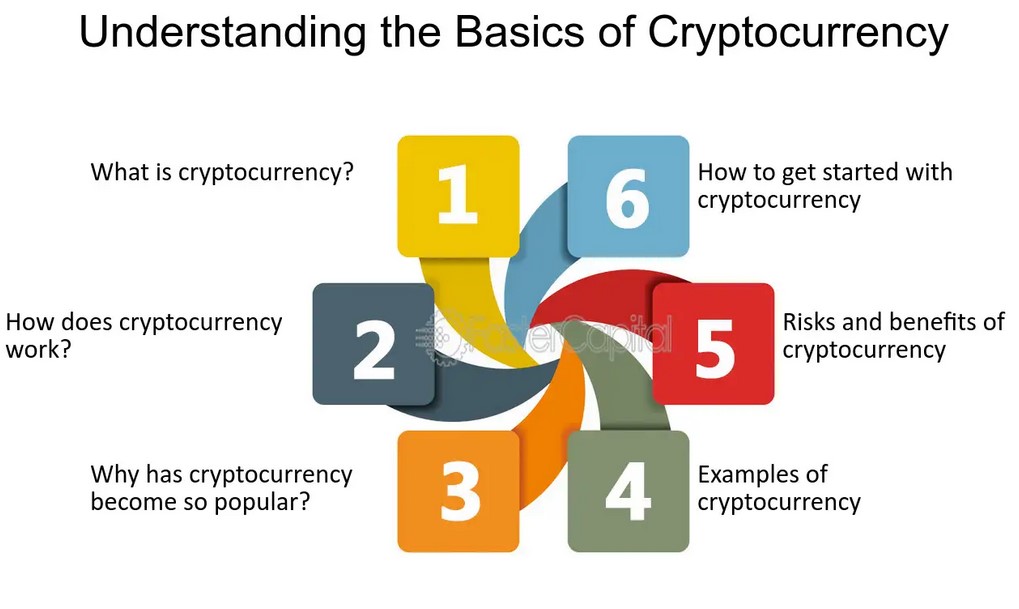

Understanding the Basics of Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that uses cryptography for security. Unlike traditional forms of money, cryptocurrencies are decentralized and typically operate on technology called blockchain, which is a distributed ledger enforced by a disparate network of computers. Bitcoin is the most well-known cryptocurrency but there are thousands of others with various features and uses.

The key feature of cryptocurrencies is their decentralized nature – they are not controlled by any government or central authority. This means that they can be sent directly from user to user without the need for intermediaries like banks. Another important aspect is the anonymity it provides; transactions can be made with only an internet connection and without giving personal identity information.

However, this anonymity and lack of regulation also make cryptocurrencies a popular tool for illegal activities. They’re also highly volatile, meaning their value can fluctuate wildly in very short periods of time. Despite these risks, interest in cryptocurrencies continues to grow due to potential high return on investment and increasing acceptance as a payment method by businesses worldwide.

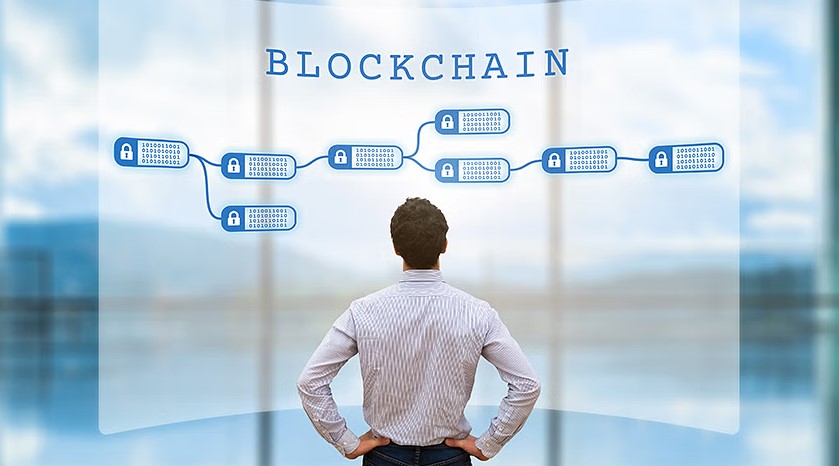

Blockchain and Cryptocurrency: A Brief Explanation

Blockchain is a decentralized ledger of all transactions across a peer-to-peer network. This technology allows participants to confirm transactions without the need for a central clearing authority, such as a bank or government. Information on the blockchain is stored in fixed structures called ‘blocks’. These blocks are linked to each other in a chronological order creating a chain of blocks – hence the name, Blockchain.

Cryptocurrency, on the other hand, is a digital or virtual form of currency that uses cryptography for security. It operates independently of any central bank and relies on blockchain technology for its operations. Bitcoin, created in 2009, was the first decentralized cryptocurrency and remains the most well-known and widely used today. Other examples include Ethereum, Ripple, and Litecoin. Cryptocurrencies allow secure, peer-to-peer transactions to take place online.

How to Buy Cryptocurrency: Getting Started

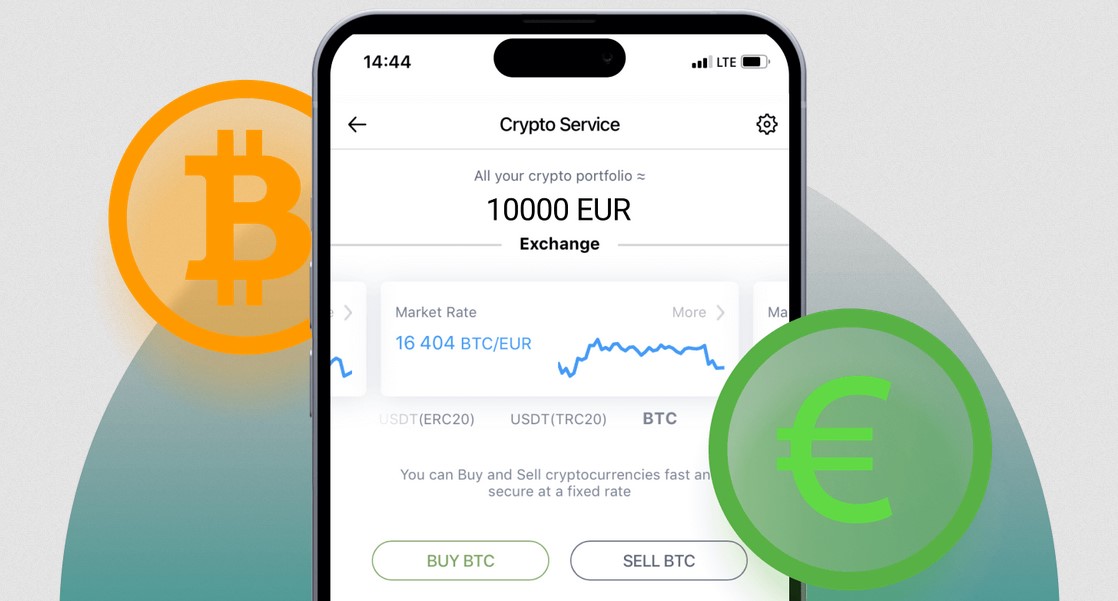

Buying cryptocurrency is a straightforward process. First, you need to set up an account on a cryptocurrency exchange platform like Coinbase, Binance, or Kraken. You’ll need to provide some personal information for verification purposes in line with Know Your Customer (KYC) regulations. Once your account is verified, you can deposit funds into it from your bank account or credit card.

Once the funds are in your account, you can start buying cryptocurrencies. The process usually involves selecting the cryptocurrency you want to buy, specifying the amount you want to purchase, and confirming the transaction. Always make sure to double-check all details before confirming as transactions with cryptocurrencies are irreversible. After the purchase, ensure that your cryptocurrencies are stored securely either in the exchange’s wallet or transfer them to a private wallet for added security.

Lastly, remember that investing in cryptocurrency carries risks just like any other investment. Ensure that you understand these risks and only invest money that you can afford to lose. It’s also beneficial to keep up-to-date with cryptocurrency news as this market can be highly volatile and changes rapidly.

Investing in Cryptocurrency: Key Factors to Consider

Investing in cryptocurrency involves several key factors that need careful consideration. One of the main factors is volatility. Cryptocurrencies are known for their extreme price fluctuations, which can result in significant gains or losses. Understanding and being comfortable with this risk is crucial before investing.

Another important factor to consider is the credibility and security of the cryptocurrency exchange you choose to use. Not all platforms offer the same level of security, so it’s essential to do your research and select a reputable one. Also, consider the liquidity of the cryptocurrency you want to invest in – higher liquidity generally means that the market for that coin is more active, which can make it easier to buy and sell.

Lastly, just like any other investment, understanding the underlying technology behind cryptocurrencies (blockchain) can help you make more informed decisions. It’s also beneficial to stay updated with news related to cryptocurrencies as it could affect their value significantly.

Understanding Crypto Exchanges and Wallets

Crypto exchanges are platforms where you can buy, sell, and trade cryptocurrencies. They facilitate the conversion of your traditional money into cryptocurrency and vice versa. Some popular crypto exchanges include Binance, Coinbase, and Kraken. These exchanges also provide a platform for trading between different types of cryptocurrencies.

Crypto wallets, on the other hand, are digital wallets where you store your cryptocurrencies. They are essentially software programs that store private and public keys and interact with various blockchain to enable users to send and receive digital currency and monitor their balance. There are different types of crypto wallets such as hardware wallets, software wallets (which can be desktop or mobile), and online (web) wallets.

It’s crucial to understand that while exchanges provide a platform for trading cryptocurrencies, they should not be used as a place to store your digital assets due to security risks. Instead, after purchasing your cryptocurrency from an exchange, it’s recommended that you transfer them into a secure wallet for safekeeping.

Tips on Safeguarding Your Crypto Investment

Firstly, ensure that your crypto investments are stored in a secure digital wallet. There are different types of wallets including hardware, software, and online wallets. Hardware wallets are considered the safest as they store your investment offline, away from potential hackers. If you use an online wallet, make sure it’s encrypted and consider using two-factor authentication for extra security.

Secondly, be cautious about where you invest your cryptocurrency. Do thorough research on any exchanges or investment platforms before you commit. Look at their security measures, reputation, and reviews from other users. Avoid sharing sensitive information about your investments on social media or other public platforms to reduce the risk of being targeted by scammers.

Lastly, stay updated on the latest trends and news in the crypto world. This includes understanding new threats and potential scams in the market. Always remember that if something seems too good to be true in the world of crypto investment, it probably is. Be patient with your investments and avoid making decisions based on fear or greed.

Making Sense of Crypto Regulations and Taxes

Understanding crypto regulations and taxes can indeed be complex, mainly because the rules vary significantly from one country to another. Many governments are still grappling with how to regulate cryptocurrencies, hence the lack of uniformity. In some countries like Japan, cryptocurrencies are legal and regulated; in others such as China, they’re largely banned.

As for taxes, generally speaking, many jurisdictions treat cryptocurrencies as property for tax purposes. This means that selling or exchanging cryptocurrency can trigger capital gains tax. However, again, this varies by jurisdiction and the specifics of your transactions. For instance, in the U.S., every transaction using digital currency is a taxable event requiring reporting.

It’s essential to consult with a tax professional familiar with cryptocurrency if you’re involved in buying or selling digital assets. They can help you navigate these complexities and ensure you comply with all relevant laws and regulations.

Blockchain Technology: The Foundation of Cryptocurrency

Blockchain technology indeed forms the foundation of cryptocurrency. It is a decentralized digital ledger that records transactions across multiple computers so that any involved record cannot be altered retroactively, without the alteration of all subsequent blocks. This allows participants to verify and audit transactions in an inexpensive way.

Cryptocurrencies like Bitcoin use this technology for secure peer-to-peer transactions, ensuring transparency and security. The decentralization of blockchain makes cryptocurrencies theoretically immune to government interference or manipulation.

Moreover, blockchain’s distributed nature also means that transactions can be confirmed without the need for a central authority, making it potentially suitable for activities like voting systems and crowdfunding. So, while blockchain is the underlying technology enabling the existence of cryptocurrencies, its applications extend far beyond just digital currencies.

Evaluating Different Types of Cryptocurrencies

Evaluating different types of cryptocurrencies involves looking at several key factors. The first is market capitalization, which refers to the total value of all coins in circulation. This gives you an idea of the size and popularity of the currency. You should also consider the liquidity of the currency, or how easily it can be bought and sold. A cryptocurrency with high liquidity is typically more stable and less susceptible to price manipulation.

Another crucial factor is the technology behind the cryptocurrency. This includes its blockchain infrastructure, transaction speed, scalability and security features. For example, Bitcoin uses Proof-of-Work (PoW) consensus algorithm while Ethereum is transitioning to a Proof-of-Stake (PoS) system which is more energy-efficient. Lastly, you should consider the use case of the cryptocurrency – whether it’s used for transactions (like Bitcoin), smart contracts (like Ethereum), privacy (like Monero), or other specific applications. These factors help determine the potential long-term value and utility of each cryptocurrency.

Setting Up a Cryptocurrency Wallet

Setting up a cryptocurrency wallet is an essential step for anyone who wants to engage in buying, selling, or trading digital currencies. The process is relatively straightforward and can be done in a few simple steps. First, you need to choose the type of wallet that suits your needs – this could be online (web-based), offline (hardware or software), mobile, or even paper wallets. Each has its own advantages and disadvantages in terms of security and convenience.

Once you’ve chosen the type of wallet, you’ll need to create it. This usually involves downloading the relevant software if it’s a software or mobile wallet, or purchasing a hardware device if it’s a hardware wallet. For web-based wallets, you simply sign up on their website. You will then set up your private keys – these are crucial as they allow you to access your funds so they should be kept secret and secure.

After setting up your wallet, remember to secure it properly. This may involve creating backups of your wallet, encrypting it with passwords and possibly enabling two-factor authentication if available. It’s also important to update the software regularly for added security. Remember that while wallets provide a way to manage your cryptocurrencies, they also come with responsibilities for their safekeeping.

Choosing the Right Cryptocurrency Exchange

Choosing the right cryptocurrency exchange depends on your specific needs and understanding of cryptocurrencies. There are several factors to consider, such as security, user interface, customer service, fees, and the types of cryptocurrencies available for trading.

Security is paramount when dealing with digital assets. Look for exchanges that have robust security measures in place such as two-factor authentication (2FA), cold storage options, and insurance against theft or hacking. The user interface should be intuitive and easy to navigate, especially if you’re a beginner.

Lastly, consider the customer service of the exchange. It’s important to choose an exchange that offers prompt and helpful customer support in case you encounter any issues or have any queries. Check out online reviews or forums for user experiences regarding this aspect. Also pay attention to transaction fees which can vary greatly between exchanges. Some might offer lower fees but may compromise on other aspects like security or customer service so make sure to weigh these factors based on your priorities.

Strategies for Successful Cryptocurrency Investing

Investing in cryptocurrency requires a well-thought-out strategy, just like any other form of investment. The first strategy is to diversify your portfolio. Don’t put all your money into one type of cryptocurrency. The market for cryptocurrencies is highly volatile and by diversifying, you reduce the risk of losing all your investment.

Another key strategy is doing thorough research before investing. Understand the technology behind each cryptocurrency, the problem it solves and its future potential. Also consider factors such as its market cap, liquidity, and price history. Finally, don’t be swayed by the hype; make informed decisions based on facts.

Lastly, it’s crucial to have a clear plan about when to exit your investments. Many investors hold onto their investments even when it’s clear that they are making losses, hoping that things will turn around. It’s important to set realistic profit targets and stop-loss levels to protect your investment. Remember that in cryptocurrency investing, patience and discipline are key.

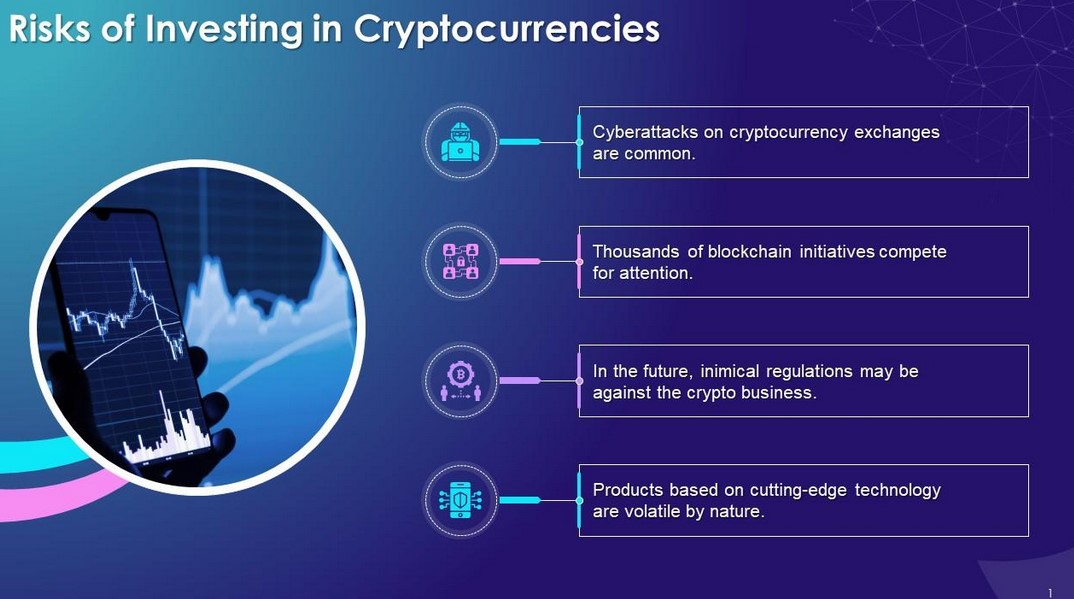

Risks and Challenges in Cryptocurrency Investment

Investing in cryptocurrency carries a number of risks and challenges. One of the primary risks is its extreme volatility. Cryptocurrency values can fluctuate wildly, sometimes within just a few hours or even minutes. This means that an investment can rapidly gain or lose value, creating potential for both high returns and significant losses.

Another challenge is the lack of regulation and security in the cryptocurrency market. Unlike traditional currencies, cryptocurrencies are not backed by a government or central bank. This means they’re susceptible to hacking, fraud, and other types of manipulation. Additionally, because it’s still an emerging field, there’s a lot of uncertainty about how cryptocurrencies will be regulated in the future, which adds another layer of risk.

Lastly, there’s the technical complexity associated with cryptocurrencies. Investing in them requires a certain level of technical knowledge to understand how they work and how to securely store and manage your investment. This barrier can make it difficult for some people to enter the market.

Conclusion

In conclusion, embarking on the journey of cryptocurrency investments is akin to navigating uncharted waters. It offers a promising terrain filled with risk, reward and revolution. The system has already begun reshaping the global financial landscape, providing an alternative method that challenges traditional banks and economies.

However, remember that every investment carries its risks – more so with cryptocurrency due to its volatile nature. The key is sensible and well-researched decisions coupled with patience and discipline in maintaining your strategy. Just as the Crypto-verse continues to evolve, so too should your knowledge and approach to it. The opportunity for wealth creation by investing in cryptocurrencies promises astounding rewards for those bold enough to ride out storms yet prudent enough not place all their eggs in one basket. Invest smartly; after all, cryptocurrency isn’t just about getting rich – it’s about being part of a ground-breaking financial evolution.